Shortlink: https://wp.me/p8JWg2-1pN

JARGON DEFINITIONS

GDP / Gross Domestic Product: This claims to be a measure of the total monetary or market value of all the finished goods and services produced within a country’s borders within a specific time period (usually taken to be 12 months).

Financialization: This term refers to the increase in size and importance of a country’s financial sector relative to its overall economy. Financialization has occurred as countries have shifted away from industrial capitalism.

The IMF and The World Bank: The main difference between the International Monetary Fund (IMF) and the World Bank lies in their respective purposes and functions. The IMF oversees the stability of the world’s monetary system, while the World Bank’s goal is to reduce poverty by offering assistance to middle-income and low-income countries. Both organizations are based in Washington, D.C., and were established as part of the Bretton Woods Agreement in 1945.

IMF Austerity Programs: These are economic policies implemented to reduce public-sector debt, by significantly curtailing government spending, particularly when a nation is in jeopardy of defaulting on its bonds. When the IMF has been approached to issue a loan, any resulting austerity programs imposed by the IMF (or World Bank) will contain a set of economic reforms that the country in crisis must adhere to in order to secure a loan from the International Monetary Fund and/or the World Bank. These reforms are packaged in Structural Adjustment Programs (SAPs).

Blogger’s Note

The transcript text that follows has been copied from Dr. Michael Hudson’s own website, before being slightly edited/syncopated by yours truly. I have written some modest additions, which are enclosed in [square brackets; coloured blue], while deleted sentences/paragraphs are indicated […] as per convention. I have also colour-highlighted certain statements to help emphasize their inherent gravitas.

To visit the original text, click here to open his webpage in a new tab.

To jump directly to the two podcast videos … click here.

§

TRANSCRIPT [selected extracts]

Précis of Dr. Hudson’s Academic History

I’ve worked for numerous think tanks and organizations putting together alternative views of the gross national product. But most of my work has actually been for governments – for the US government, the Canadian government on international finance, the Latvian government on tax policy, Chinese government on general history of economic thought. I was a professor at Peking University, which is sort of the Harvard University of China, for a number of years. And at Hong Kong, at the university there.

So, the common denominator of what I’ve been doing is that I think academic economics is on the wrong track. As soon as I’d begun to teach international trade theory at the New School in 1969, I found everything that it said was wrong. And everything that it forecasts for how free trade and an absence of a tariff protection – especially following IMF austerity programs – would help grow.

I had numerous visits to Washington with the White House, the Treasury. They all said that the way to grow is to cut labor’s wages, cut labor’s living standards, and essentially force governments to sell off their raw materials, resources, and lands to [International] Finance.

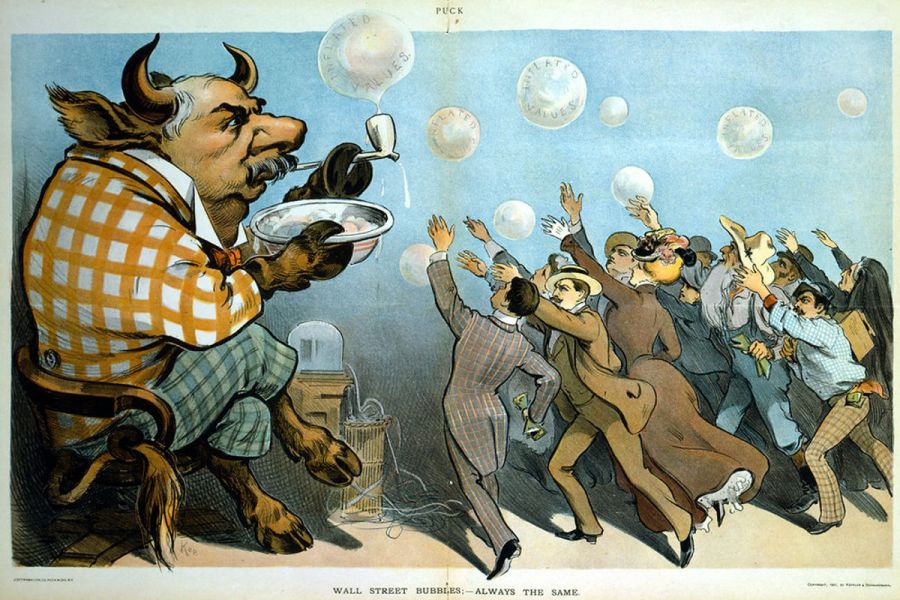

Wall Street and Financialization

And the universal message of almost all of the Wall Street people I worked with, and of academia, was that the way to get rich is to financialize the economy. You’ll get rich by going into debt, and using debt to buy houses, real estate, stocks and bonds and increase their prices. And the whole idea of getting rich was all about not producing more goods and services, but to increase asset prices: real estate, stocks and bonds. And you increase them by going into debt. And the more debt the economy had, the less money it had for profit.

So, for the last 10 years in the United States, 92% of the profits of the Fortune 500 companies have been used to buy stocks – their own stock buyback programs – or to pay out as dividends. Only 8% is used on new investment.

Deindustrialization is Good

And the main message of mainstream economics is [that] you want to offshore labor. You want to deindustrialize. You want a post-industrial society. If you could just move as much of America’s industry as possible to China and to Asia, there’ll be more profits for the firms [i.e., the Corporations], and that will increase the stock prices, and the economy is going to get richer.

Obviously, it doesn’t work. This is the advice that’s given to global south countries to develop. It’s the basis of [the] IMF’s so-called “stabilization programs”.

I found that there’s a kind of Orwellian vocabulary in academic economics, which is really why I stopped teaching regularly. And the vocabulary essentially turns everything inside out.

[ … ]

The function of industrial capitalism, and of all of the British political economy that [Karl Marx] described in the 19th century was to free markets from landlords – the hereditary landlord class that had inherited the land in England and Europe. To free economies from predatory banking and to use banking to actually finance industrial production. And to free economies from monopolies.

[ …]

The role of markets under industrial capitalism is to get rid of economic rents.” To get rid of land rent, and monopoly rent, and interest charges that are not productive at all. So that you want to minimize the cost of living. You want to minimize the cost of doing business – because if employers don’t have to pay labor more and more money to pay for housing, for healthcare, for education, then they can out-compete with other countries.

[ …] to make a long story short, I found that the policies of the United States today are deliberately deindustrializing. And in fact, they’ve been deindustrializing to such an extent that even if the United States were to try to reindustrialize and bring labor back home, it would have to raise prices by about 500%, living standards would have to fall by about 30%. And that’s because if you were to give American labor all of their clothes, all of their transportation, all of their food, everything physical for nothing, American labor still could not compete. Because its housing costs, its health care costs, its monopoly rents, its debt service – all of these charges price American labor out of the market. None of this appears in classical economic theory.

Basically, the economic theory today is the reverse of what Adam Smith and John Stuart Mill and Ricardo and the whole 19th century looked at for how an economy should develop. The objective of the economy today is to maximize economic rent – it’s what the economists of the 19th century called unearned income.

Gross National Product (GDP)

If you look at the gross national product accounts of the United States, they depict America is getting richer and richer when people have to pay higher rents. And richer and richer if you own a home and your housing price is inflated. In the national income and product accounts, they say that if a homeowner were to rent out his house to himself, what would he charge for the rent? Well, as rents go up, as if housing prices go up, GDP goes up.

One way to accelerate GDP is to fall behind in your credit card accounts. If you fall behind in your credit card payments, then your interest rates go up from 19% to a penalty rate of 29%. The [nonsensical] GDP accounts say that that is [the equivalent of] providing “financial services,” and GDP goes up [and therefore the nation’s GDP can be marked higher, which the brash, New Yawk accented financial networks can then report as “good news”].

[ … ]

Disease actually has been helping GDP quite a bit because you have to now pay 18% of America’s GDP for the Obamacare, for medical care – much higher than the proportion of any other country. All of these things are considered GDP.

Robbery helps the GDP go up and burglary because people have to replace what’s taken. So, the GDP is a travesty of any measure of welfare or size. And it’s a travesty of comparing a post-industrial economy like the United States – where the objective is not to produce anything at all, but to import it all – and economies that actually produce goods and services.

§

Backup versions of The DemystifySci Podcast interview (Parts 1 and 2).

By clicking “Like” (below) you will improve this blogpost’s SEO and increase the likelihood of it being discovered by others. Thnx!